Last month Washington voters passed Initiative 1185, a third Initiative from conservative activist Tim Eyman that imposes a two-thirds majority requirement to raise any revenue in Washington State.

In 2007, Initiative 960, Eyman’s first 2/3 Initiative passed with 51.24% of the vote. In 2010, after the legislature overturned 960, Eyman’s 1053 passed with 63.75% of the vote. Currently 1185 is passing with 63.91% of the vote. Tellingly, none of these bills would have become law if they were subject to the same 2/3 requirement placed upon the legislature.

In fact, none of the ballot measures on the 2012 ballot would have passed the 2/3 requirement. No marriage equality (54%), no marijuana (56%), no charter schools (50.69%). Even President Obama didn’t manage to pull in 2/3 of the electorate in deep blue Washington state.

Which is part of why a King County Superior Court found Initiative 1053 unconstitutional back in May of this year. Super-majority requirements are in practice unattainable. The State Supreme Court has yet to set a date on when they will decide on the case, but will likely do so before the January legislative session. If they don’t, the 2/3 majority requirement will still be considered unconstitutional when state legislators return to Olympia.

What’s At Stake:

Washington State is not paying its bills. After a drawn-out recession, we’re simply not raising enough revenue to keep up with a very baseline upkeep. Our state-based revenue system falls disproportionately on the poor and is slow to adapt to changes in market conditions and demographic shifts and trends.

The Washington State Budget and Policy Center finds that state revenue is projected to come in at $4.8 billion less than our current obligations. This includes vital state services plus our state’s “new” obligation to fund schools due to the Supreme Court’s McCleary decision.

As just one example of many, according to the 2010 census, Washington State spends $9,452 per student each year. Contrast that with Washington DC, which spends $18,667. Do we value our student’s education half as much as our country’s capital?

Can’t Squeeze Blood from a Stone

Washington voters are pretty consistent about their desires to lower taxes. On the same ballot voters approved the 2/3rds requirement, they rejected two non-binding advisory votes to raise revenue by removing a deduction used by large out-of-state banks and delaying the expiration of a current tax on petroleum manufacturers. (Both votes have mere symbolic effect thanks to a prior Eyman Initiative.)

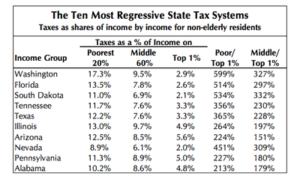

And I’m empathetic. Low-income and middle income Washington residents are feeling the squeeze. (As is my broke ass.) According to a report by the Institute on Taxation & Economic Policy, Washington’s poorest residents pay up to 17.3% of their income into state coffers while Washington’s richest pay just 2.9%. We live in a very high-tax state if you’re poor and a very low-tax state if you’re rich.

But there are ways to raise revenue that don’t soak the poor. Last session legislators attempted to create a modest tax on capital gains – i.e. the money earned from sales of stocks or property. Capital gains are almost ubiquitous amongst the richest members of Washington State, and rare among low-income and middle-class Washingtonians. The bill that failed to pass last session exempted the first $10,000 in capital gains, resulting in a tax on only the richest 3%.

A capital gains tax would be one of many possible ways to get Washington out of debt. But ideas like this are non-starters while Olympia is shackled by 2/3rds requirements.

Regardless of how we do it, until Washington gets real about paying for the things we value, we’ll continue to underfund schools, roads, transit and life-saving services. It’s time for the Evergreen State to put its money where its mouth is.

This blog post was written by Devin Glaser, longtime friend and volunteer of the Bus.